How to set up your Product Tax Code on your Amazon Products.

Why set up a product tax code on SellerCentral ?

Setting up a product tax code on SellerCentral is an essential step for any Amazon seller. This code determines how your products are taxed, and it can have a major impact on your bottom line. There are several key considerations when setting up your product tax code, such as choosing the correct category for your products and understanding how rates and exemptions may vary across different regions.

Disclaimer: For legal and tax advice consult with a licensed professional.

Why setup Product Tax Codes ?

To use Amazon's sales tax collection service, FBA sellers need to assign each product a product tax code. This code will instruct Amazon on how much tax to charge customers in states that require taxes to be collected. While not all items can be categorized with a product tax code, ones that may be taxed differently depending on the jurisdiction should have one assigned so they are charged correctly no matter which state it gets sold in.

Are product tax codes managed differently in different regions?

There are key differences between the European and North American market. The main difference is that tax in Europe is shown before the checkout on the product page whereas in the USA tax is added at the checkout.

Can I add product tax codes to my items in bulk?

Yes, the "Add products via Upload" feature allows users to quickly and efficiently update tax codes in bulk, eliminating the need for manual data entry and providing faster results.

A_GEN_TAX vs specific Tax Code ?

By the default the product tax code is set as A_GEN_TAX. This tells Amazon that your product is taxable but doesn't require any extra considerations for sales tax. Some product categories can have lower tax and should therefore be adjusted and set up manually.

Products in the following categories generally have special tax considerations and should therefore be set manually:

- Books and Periodicals

- Clothing

- Computers

- Food - Groceries

- Health & Beauty Products

- Infant & Baby Supplies

- School Supplies

- Sporting Goods

Each state and country taxes products in a different ways that could have a great impact on your bottom line. In the UK for example potato crisps are taxed at 20% whilst tea at 0% (Source: Gov.uk)

How to edit your Product Tax code on SellerCentral

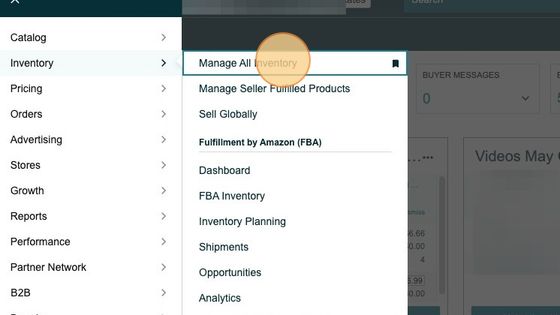

1. Navigate to https://sellercentral.amazon.com/home

2. Click "Manage All Inventory" from the Menu

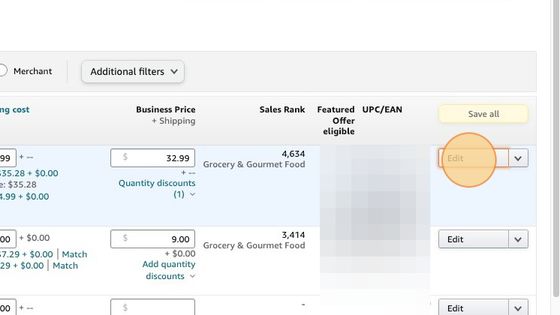

3. Select the product you would like to edit and Click "Edit"

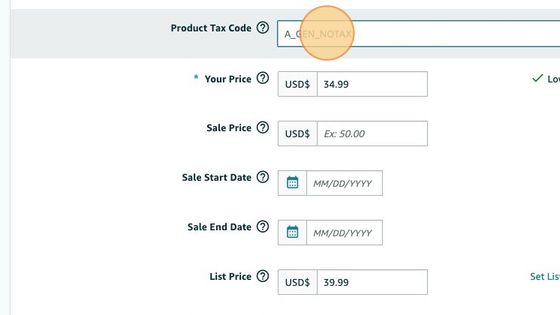

4. From the field "Product Tax Code" select the desired Product Tax Code.

5. The tax code A GEN TAX is the default general tax code.

We suggest that you consult with a licensed tax advisor to select the most appropriate code to your product.

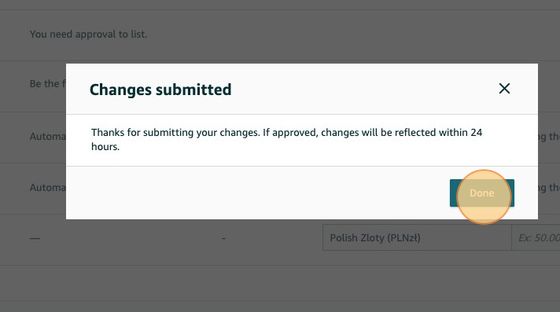

6. Validate your changes

7. Click done to finish the process.